As the 2026 tax season approaches, millions of Americans are preparing their financial documents and looking ahead to one important question: when will my IRS tax refund arrive? For many households, a refund is more than a routine payment. It can support savings goals, reduce debt, fund investments, or provide breathing room in a high-cost economy.

While the IRS does not publish a personalized refund calendar for each taxpayer, historical processing patterns and official procedures offer a dependable framework. Understanding how refunds are calculated, processed, and delivered can help you plan with confidence.

How IRS Tax Refunds Are Calculated

At its core, a tax refund reflects the difference between what you paid throughout the year and what you actually owed.

Employers withhold federal income tax from each paycheck based on the information you provide on your W-4 form. When you file your return, the IRS calculates your total tax liability using your annual income, filing status, deductions, and credits. If your total payments exceed your liability, you receive the difference as a refund.

Several elements influence your final refund amount:

Tax Credits

Credits directly reduce the tax you owe and can significantly increase your refund. Common examples include:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- Education credits

- Energy-efficiency incentives

Refundable credits may generate a refund even if you owe little or no tax.

Deductions

Deductions reduce your taxable income. Whether you take the standard deduction or itemize, your choice impacts how much tax is ultimately calculated.

Changes in Income or Withholding

Even if your employment situation seems stable, small shifts in salary, bonuses, freelance income, or withholding adjustments can change your refund outcome from one year to the next.

When the 2026 Tax Filing Season Is Expected to Begin

The IRS typically opens federal tax filing in late January. The official opening date marks when returns begin to be accepted and processed.

Taxpayers who file early — especially those who e-file — often enter the processing queue first. If your return is accurate and complete, refunds may begin appearing in bank accounts within the first few weeks of the season.

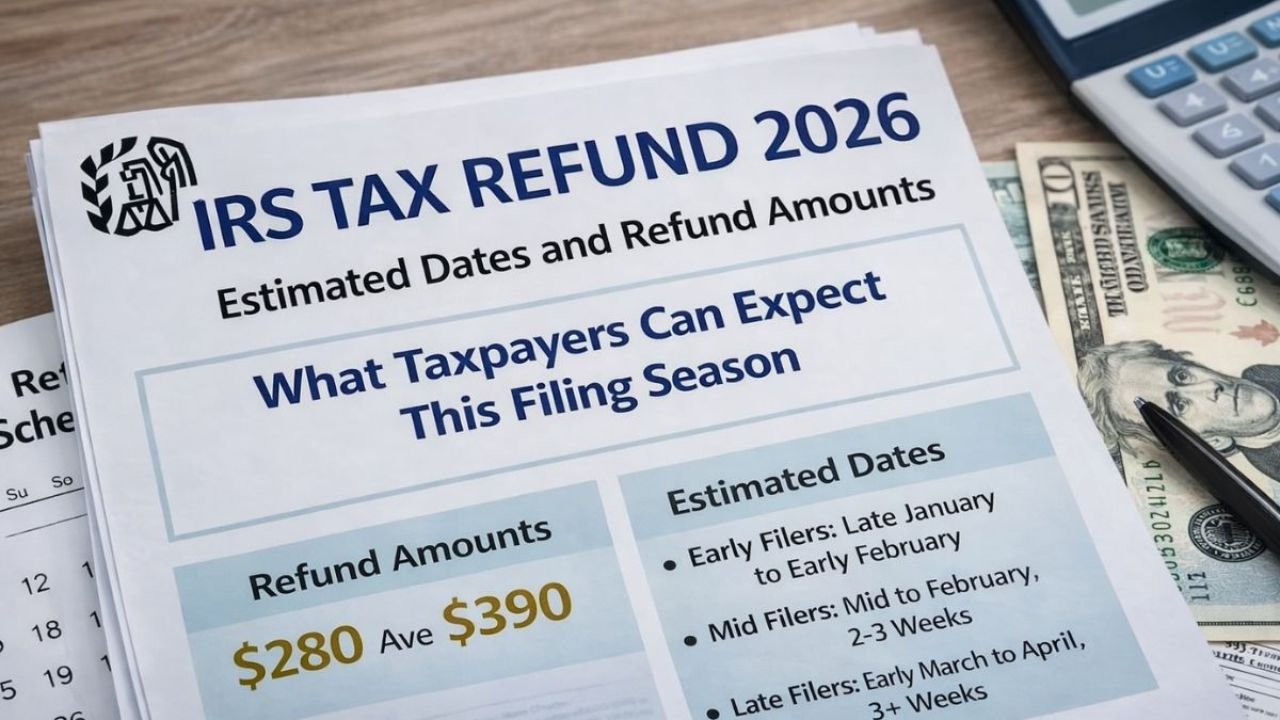

Historically, the refund timeline follows a general rhythm:

- Late January to early February: First wave of direct deposits

- Mid-February: Peak processing period

- March through early April: Continued refunds for later filers

- After April deadline: Refunds for late or amended returns

While these patterns are consistent, actual timing depends on individual circumstances.

Estimated IRS Refund Timeline for 2026

Although exact dates vary, most electronically filed returns with direct deposit are processed within 21 days of acceptance.

Here’s how the timeline typically works:

- Return Accepted – The IRS acknowledges receipt of your return.

- Refund Approved – Your return has completed processing.

- Refund Sent – Funds are issued via direct deposit or check.

Direct deposits usually appear within a few business days after approval. If the deposit date falls on a weekend or federal holiday, funds typically post the next business day.

Paper returns require manual handling and can take significantly longer — often six to eight weeks or more.

Direct Deposit vs. Paper Check: What’s Faster?

Delivery method plays a major role in timing.

Direct Deposit

- Fastest option

- Most refunds arrive within about three weeks

- Reduces risk of lost or delayed mail

- Can be split across multiple accounts

Paper Check

- Requires printing and mailing

- May add several weeks to delivery

- Higher risk of postal delays

For taxpayers focused on speed and security, electronic filing combined with direct deposit remains the most efficient choice.

Why Some Refunds Are Delayed

Even during a smooth tax season, certain factors can slow processing.

Errors or Missing Information

Incorrect Social Security numbers, mismatched income documents, or math errors can trigger additional review.

Identity Verification

If the IRS needs to confirm your identity, processing may pause until verification is complete.

Certain Tax Credits

Refunds that include the Earned Income Tax Credit or Additional Child Tax Credit are often subject to temporary holds early in the season due to statutory requirements.

High Filing Volume

Mid-season surges can occasionally create minor backlogs, particularly in February.

Filing early, reviewing your return carefully, and ensuring all required forms are included can reduce the risk of delays.

How to Track Your 2026 IRS Refund

After filing, you can monitor your refund using the IRS online tracking tools. Status updates typically appear within:

- 24 hours for e-filed returns

- Several weeks for paper returns

The tracking system updates once daily, usually overnight. Checking multiple times per day will not speed up processing.

If your status shows “Refund Sent,” your deposit should appear shortly after, depending on your bank’s posting schedule.

Smart Ways to Use Your Tax Refund

For financially disciplined households, a refund presents an opportunity.

Consider allocating your refund strategically:

- Build or strengthen an emergency fund

- Pay down high-interest debt

- Contribute to retirement accounts

- Invest in professional development

- Upgrade essential household needs

Planning in advance helps ensure your refund supports long-term financial stability rather than short-term spending.

What to Expect from the 2026 Refund Season

Based on established IRS procedures, the 2026 refund season is expected to follow familiar patterns. Most taxpayers who:

- File electronically

- Choose direct deposit

- Submit accurate and complete information

should receive refunds within the standard 21-day window.

While no two returns are identical, understanding the structure of IRS processing removes much of the uncertainty. Preparation and accuracy remain your strongest advantages.

Final Thoughts

The IRS Tax Refund 2026 schedule may not come with guaranteed dates for every taxpayer, but the system operates within a predictable framework. Filing early, choosing direct deposit, and double-checking your information can help ensure your refund arrives as efficiently as possible.

For many Americans, that refund represents more than a deposit — it’s a financial reset, a planning tool, and sometimes a stepping stone toward greater stability. Knowing what to expect allows you to approach tax season with clarity and confidence.

Disclaimer

This article is for general informational purposes only and does not constitute tax, legal, or financial advice. IRS procedures, timelines, refund amounts, and eligibility rules may change and vary based on individual circumstances. For personalized guidance, consult official IRS resources or a qualified tax professional.